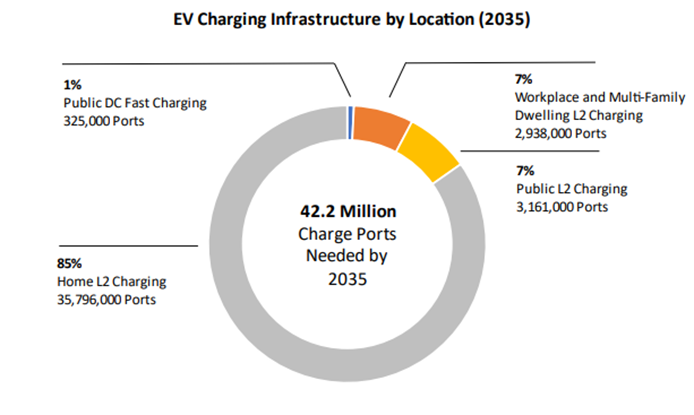

According to the Edison Electric Institute, the number of electric vehicles on U.S. roads in 2035 is estimated at 78.5 million in comparison to the 4.5 million that we saw at the end of 2023. To support this increased number of EVs, more than 42.2 million charge ports will be required. This ranges from L2 ports located within homes and workplaces to DC fast chargers (DCFC) in public areas.

EV Charging Market

Currently, the vast majority of EV charging is facilitated at home. Looking into the future, it is predicted that this will continue to be the primary way to charge your electric vehicle.

The EEI’s report estimates that by 2035 around 85% of the charge ports needed to support the large increase of electric vehicles on the road will come from Level 2 home chargers. Level 2 chargers most often installed at home for personal use, have an approximate charge time of 12 hours. This results in the need to charge a vehicle overnight.

7% of the charging ports will come from workplace charging. These L2 chargers have a charging time of approximately 8 hours. The additional 7 percent of the charging ports needed by 2035 are going to be public chargers. These chargers are usually found in dedicated charging areas for electric vehicles in places like grocery stores or airports. These types of chargers have an approximate charging time of 2 or more hours. Finally, 1% of the 42.2 million charging ports required by the end of 2035 will stem from public DC fast chargers. The DCFCs have a charge time of approximately 30 minutes. What makes these chargers much faster than the other types mentioned above, is that they bypass the onboard charger and charge directly to the battery. These charges will be a crucial part of the infrastructure that will support long-distance EV travel.

EV Charging Infrastructure in 2035 Based on EEI Forecast (Source: EV-Forecast-Infrastructure-Report)

Planning for 2030 and beyond

A majority of the electric vehicle charging market is focused on the year 2030 and creating a starting point for a fast-growing infrastructure. As of July 2024, there are 134,000 public Level 2 chargers and 44,000 DC fast chargers. The leap from the current supply to 6 million public chargers continues to be a major challenge. The EV sales continue to soar but the pace at which the charging infrastructure is expanding is not fast enough to reach any of the 2030 and beyond goals.

Automakers are working towards adopting a charging design that works with the majority of all charging ports. After Tesla developed the Supercharger network of 26,000 public DC fast chargers exclusively for their vehicles, other car companies such as Ford, Audi, BMW, Nissan, and Volkswagen announced their conversion to Tesla’s charger design, now known as the North American Charging Standard (NACS). More recently, BMW, General Motors, Honda, Hyundai, Kia, Mercedes, and Toyota all joined forces to launch the Ionna charging network with a mission to install 30,000 charging ports by the end of 2030.

Another major focus of the EV charging market is the growth and development of DC Fast Chargers. While it is projected they will encompass only 1% of the chargers needed by 2035, they are still the main focus for policymakers and electric companies. The capability to charge a vehicle in only 15 minutes to 80% capacity (depending on the size of the EV battery and the power level of the charging station), changes the future of EV long-distance travel. The drawback and main reason for slower infrastructure growth is the installation and maintenance cost.

The EV statistics and trends show continuous major increases in the stock of electric vehicles on American roads. There is an exponential need for an increase in charging ports to support the fast-growing EV demand.

Sources: